PulseChain1, launched on May 13th of 2023, is a layer-1 blockchain that performed a full system state copy of Ethereum. This process cloned all Ethereum tokens, including their holders’ balances, resulting in what may be the largest airdrop in cryptocurrency history. Among these tokens is pWBTC, the PulseChain clone of Wrapped Bitcoin2 (WBTC), an ERC20 token backed 1:1 by Bitcoin on Ethereum. pWBTC, a PRC-20 token, aims to bring Bitcoin’s value to PulseChain’s ecosystem.

This article will explore pWBTC’s origins, current status, technical aspects, utility, community concerns, security features, and the role of key stakeholders, providing a thorough understanding of its potential and challenges.

🌐 PulseChain and the Genesis of pWBTC

PulseChain is designed to address Ethereum’s limitations by offering faster and cheaper transactions. By cloning Ethereum’s state, PulseChain created PRC20 versions of all ERC20 tokens, including WBTC, which became pWBTC. The supply of pWBTC is fixed at 154,410 tokens, mirroring the WBTC supply on Ethereum at the time of the snapshot. This cloning process ensures that pWBTC retains the same contract logic as WBTC, verified by the identical contract address: 0x2260FAC5E5542a773Aa44fBCfeDf7C193bc2C599 PulseChain’s independent blockchain status prevents collisions with Ethereum, allowing pWBTC and WBTC to coexist as separate ledger entries with the same contract address.

📊 Current Market Position and Price Dynamics

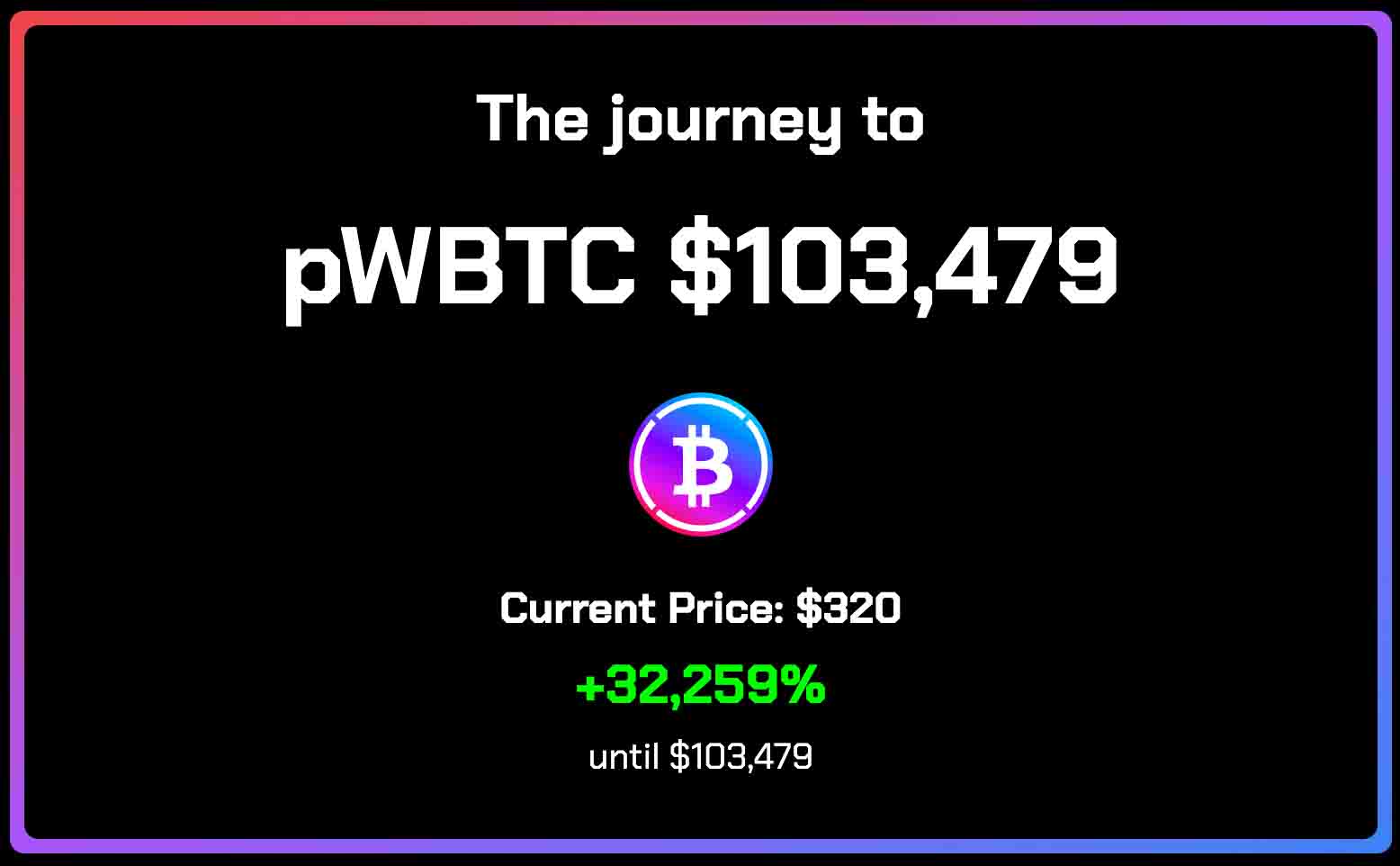

As of May 9th of 2025, pWBTC is priced at approximately $320 (Dexscreener3), while Bitcoin trades at around $103,000 (CoinMarketCap4). This price disparity implies that pWBTC would need to increase by approximately 330 times to reach parity with Bitcoin, a speculative scenario that has captured the attention of the PulseChain community. Unlike WBTC, which is actively backed by Bitcoin held by BitGo, pWBTC’s value is determined by supply and demand within PulseChain, as BitGo does not officially support the network. The fixed supply of 154,410 tokens, combined with potential DeFi utility, fuels optimism about pWBTC’s growth prospects.

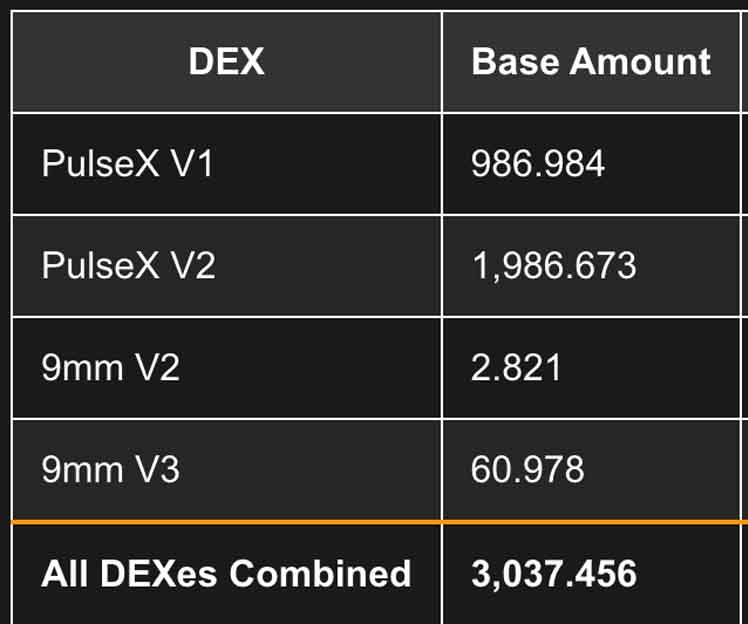

At the time of writing this, there is only ~3,000 pWBTC available to be bought across all liquidity pools. That’s only ~2% of the total supply, showing the scarcity of the token. You can use this liquidty-pools tool5 to get more info.

🧑🔧 BitGo’s Role and Acquisition

BitGo, established in 2013, is the custodian for WBTC on Ethereum, holding the underlying Bitcoin to ensure a 1:1 backing. On May 5th of 2021, Galaxy Digital acquired BitGo for $1.2 billion in a cash and stock deal, marking the first billion-dollar transaction in the cryptocurrency industry. This acquisition underscored BitGo’s prominence in digital asset custody.

For WBTC, BitGo’s role6 is limited to approving minting and burning requests initiated by authorized merchants, ensuring that the token supply aligns with Bitcoin reserves.

On PulseChain, BitGo’s involvement is minimal, as the company does not recognize or support pWBTC (yet?) due to PulseChain’s status as an unsupported fork. BitGo’s wallet: 0xCA06411bd7a7296d7dbdd0050DFc846E95fEBEB7 shows no transaction history or even sufficient PLS to transact, indicating no active custodial role. Consequently, pWBTC operates as a market-driven asset without direct Bitcoin backing, relying on PulseChain’s ecosystem for its value proposition.

🛠️ Utility of pWBTC in PulseChain

pWBTC offers significant potential utility within PulseChain’s DeFi ecosystem, mirroring WBTC’s role on Ethereum. While specific protocols like Compound or AAVE may not be directly available, PulseChain hosts various DeFi platforms where pWBTC can be used for lending, borrowing, and yield farming. For instance, users can supply pWBTC to liquidity pools or staking protocols to generate yield, leveraging PulseChain’s low transaction fees.

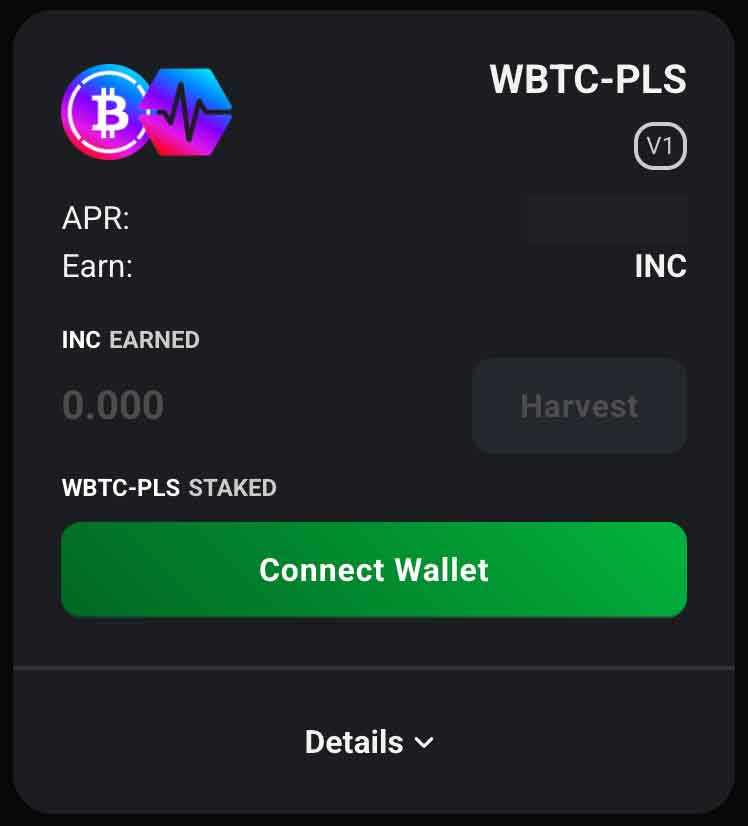

In PulseX7, PulseChain’s leading decentralized exchange (DEX), pWBTC was previously utilized in v1 farms, such as pWBTC-eWBTC and pWBTC-PLS pairs. Liquidity providers in these farms earned INC tokens, PulseX’s incentive token, without incurring entry or exit fees. The term “eWBTC” refers to a bridged version of WBTC from Ethereum, maintaining its value close to Bitcoin’s price, in contrast to pWBTC’s market-driven price.

Are we going to see pWBTC PulseX v1 farms reinstantiated sometime soon?

💬 Community Speculations and Concerns

The PulseChain community is optimistic about pWBTC’s potential to reach Bitcoin’s price, a scenario that would be unprecedented given its initial zero value at launch. Achieving parity would require a 330x price increase, driven by increased adoption, liquidity, and DeFi utility. However, concerns persist about the risk of unauthorized minting or price manipulation, particularly involving BitGo.

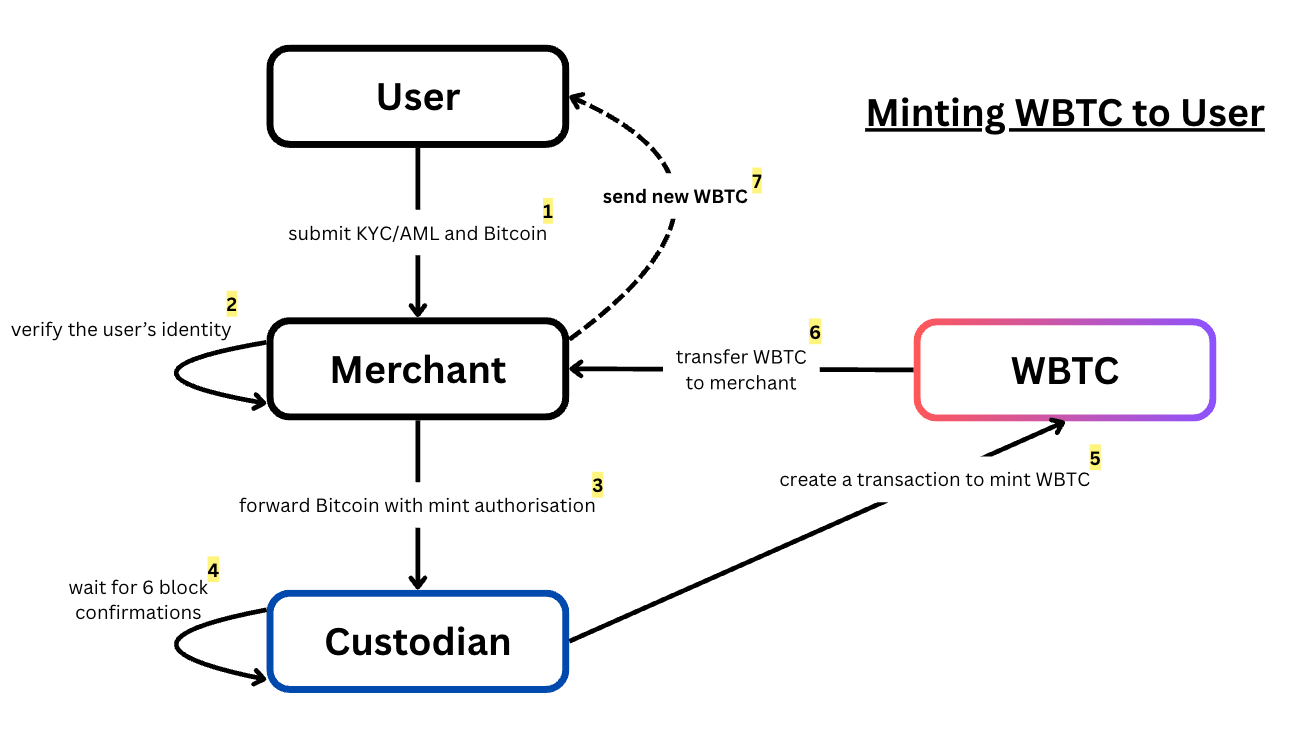

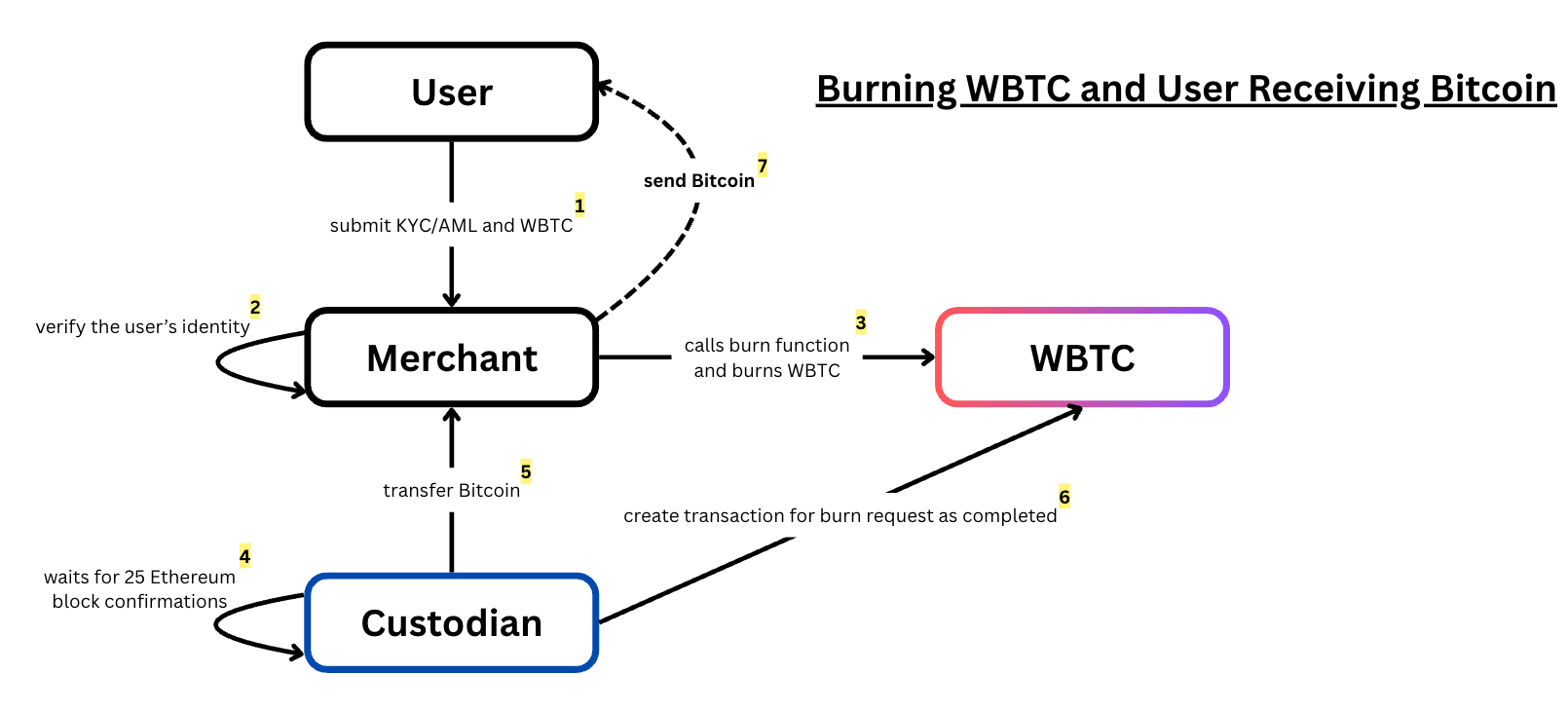

These concerns are largely mitigated by the WBTC contract’s governance structure, which is replicated in pWBTC. The contract is controlled by a multi-signature wallet requiring 8 of 13 votes from DAO members8, including reputable entities like MakerDAO and Kyber Network. This decentralized governance ensures that no single party, including BitGo, can unilaterally mint or burn tokens. Minting requires merchants to send Bitcoin to BitGo, which then approves the issuance of WBTC on Ethereum. On PulseChain, the absence of active merchants and BitGo’s non-support further reduces the likelihood of minting, as no such infrastructure exists.

From the diagrams above, which were created based on the information provided in the WBTC whitepaper9, it shows that BitGo cannot mint or burn WBTC directly; merchants initiate these processes, ensuring a 1:1 asset backing. It’s also important to note that all transactions are recorded on public blockchains verifiable via block explorers.

Another concern is whether BitGo could pause pWBTC transfers, as the contract inherits the PausableToken class, allowing the owner to halt transactions.

/**

* @title Pausable token

* @dev StandardToken modified with pausable transfers.

**/

contract PausableToken is StandardToken, Pausable {

function transfer(

address _to,

uint256 _value

)

public

whenNotPaused

returns (bool)

{

return super.transfer(_to, _value);

}However, the multi-sig DAO’s structure makes arbitrary pausing unlikely, as it would require coordinated approval from multiple members with significant reputational stakes. Additionally, unlike stablecoins such as USDT and USDC, pWBTC lacks a blacklist function, preventing arbitrary freezing of tokens and enhancing user control.

⚙️ Mechanics of Price Stability

On Ethereum, WBTC maintains parity with Bitcoin through arbitrage and the mint/burn mechanism. If WBTC trades at a premium (e.g: $100,100 when Bitcoin is $100,000), users can mint WBTC by locking Bitcoin, selling it at the higher price, and profiting. Conversely, if WBTC trades at a discount (e.g: $99,990), users can buy WBTC from exchanges, burn it to redeem Bitcoin, and profit from the difference. This process relies on automated market makers (AMMs) using the constant product formula (x*y=k), eliminating the need for oracles, which are potential points of failure.

For pWBTC, the lack of a mint/burn mechanism (for now) on PulseChain means its price is driven by market dynamics rather than direct arbitrage with Bitcoin. However, the fixed supply and potential DeFi utility could drive demand, potentially aligning pWBTC’s price with Bitcoin’s over time. The reliance on AMMs ensures transparency and predictability, reducing uncertainties associated with external data feeds.

🔐 Security and Decentralized Control

The security of pWBTC is bolstered by its contract design and governance. The absence of a blacklist function, unlike some stablecoins, ensures that tokens cannot be frozen or seized, aligning with principles of true decentralization. The multi-sig wallet, requiring 8/13 votes, prevents unilateral actions by any single entity, including BitGo. The contract’s pausability, while a theoretical risk, is mitigated by the DAO’s decentralized structure, which includes prominent DeFi projects with significant reputational and legal incentives to act responsibly.

Analysis of the contract code confirms these security features. The mint and burn functions are restricted to the owner, identified as the multi-sig wallet, and the pause function requires similar authorization. The lack of direct minting authority for BitGo, combined with the need for merchant-initiated requests, further safeguards pWBTC against manipulation.

👤 The 2822 Wallet and Richard Heart’s Influence

A significant holder (21% of the supply) of pWBTC is the wallet address 0x3899e2B00fe4eDa542021780039d69a583Dd2822, known as the 2822 wallet. This wallet is rumored to be associated with Richard Heart10, the founder of PulseChain, and is believed to function as an AMM harvester wallet. It reportedly acquired large quantities of forked tokens, including pWBTC, and redeployed liquidity to stabilize market caps across PulseChain’s ecosystem. The wallet was airdropped substantial amounts of PLS (~6.2 trillion) and PLSX (~6.7 trillion) at launch, underscoring its pivotal role.

This suggests a strong backing for pWBTC and PulseChain’s broader narrative. Heart’s vision of creating a faster, cheaper alternative to Ethereum, combined with strategic liquidity management, enhances confidence in pWBTC’s long-term prospects.

However, the lack of official confirmation from Richard Heart warrants cautious optimism. It’s very important to have a probabilistic approach.

🎬 Conclusion

pWBTC on PulseChain represents a unique narrative within the cryptocurrency landscape. As a cloned version of Ethereum’s WBTC, it inherits robust contract logic and decentralized governance, ensuring security and user control.

While challenges remain, including the lack of official custodial support and the speculative nature of its price trajectory, pWBTC’s fixed supply, decentralized control, and strategic management by key stakeholders like the 2822 wallet provide a strong foundation for growth.

I hope you enjoyed reading this article. This marks my first ever article! I decided to start writing about PulseChain because I truly believe in this ecosystem and what it has to offer to millions. I’m just doing my part of the community to demystify the world of DeFi and maket it more accessible to all! True decentralisaton is economic freedom. And that leads to economic growth, which results in increasing everyone’s quality of life! 🙌

pWBTC’s journey may redefine the possibilities of wrapped tokens in the cryptocurrency space.

If you found my work helpful, consider supporting my work by tipping the following address: 0x33c8d03B5C374Aec54D26C6c637E0D70d19363eC

- https://pulsechain.com/ ↩︎

- https://coinmarketcap.com/currencies/wrapped-bitcoin/ ↩︎

- https://dexscreener.com/pulsechain/0x46e27ea3a035ffc9e6d6d56702ce3d208ff1e58c ↩︎

- https://coinmarketcap.com/currencies/bitcoin/ ↩︎

- https://liquidity-pools.vercel.app/ ↩︎

- https://www.wbtc.network/dashboard/partners ↩︎

- https://pulsex.com/ ↩︎

- https://github.com/WrappedBTC/DAO ↩︎

- https://wbtc.network/assets/wrapped-tokens-whitepaper.pdf ↩︎

- https://x.com/RichardHeartWin ↩︎